The Thayi Lakshmi Bond Scheme is a welfare initiative introduced by the Government of Karnataka with the aim of strengthening the financial security of women and mothers from economically weaker sections. This scheme mainly focuses on encouraging savings, improving social stability, and supporting women during important stages of life. Below is a complete step-by-step guide explaining eligibility, benefits, documents required, and the application process.

What is the Thayi Lakshmi Bond Scheme?

The Thayi Lakshmi Bond Scheme is a government-backed savings and support program designed for eligible women beneficiaries. Under this scheme, a bond or financial assurance is issued in the name of the beneficiary woman. The amount invested grows over time and can be used for family needs, children’s education, health expenses, or emergencies. The scheme reflects the government’s commitment to empowering women financially and socially.

Key Benefits of Thayi Lakshmi Bond Scheme

One of the biggest advantages of this scheme is long-term financial security. The bond ensures that women have a guaranteed support amount after a specific period. It also promotes a saving habit among families who otherwise may not have access to formal financial instruments. In addition, the scheme offers government assurance, which makes it safer than many private savings options. For low-income households, this scheme acts as a protective financial cushion.

Eligibility Criteria

To apply for the Thayi Lakshmi Bond Scheme, applicants must meet certain eligibility conditions:

- The applicant should be a permanent resident of Karnataka

- The beneficiary must be a woman or mother as defined under the scheme guidelines

- The family should belong to an economically weaker or low-income category

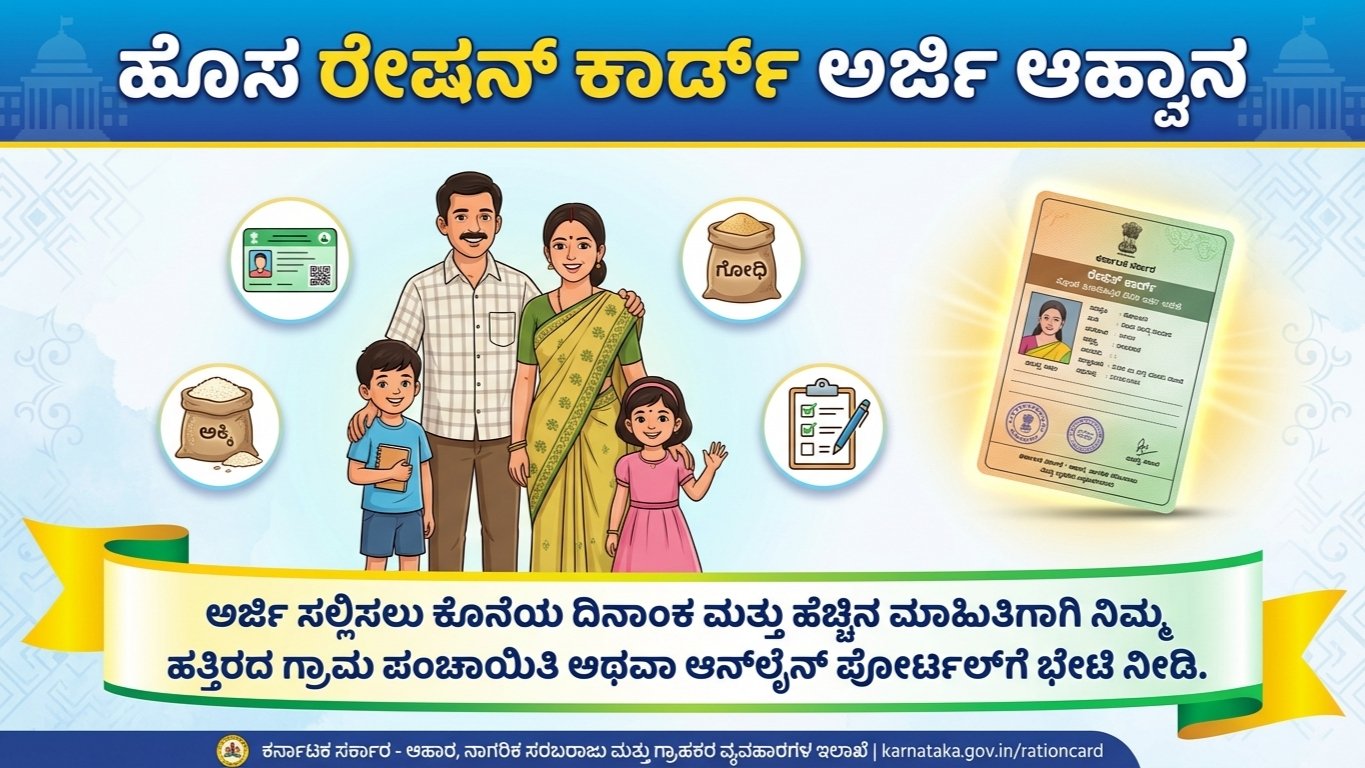

- The applicant should possess a valid ration card

- Aadhaar linkage is mandatory for identity verification

Meeting these criteria is essential to ensure that the benefits reach the intended beneficiaries.

Documents Required

Applicants should keep the following documents ready before applying:

- Aadhaar Card

- Ration Card

- Income Certificate

- Residence Proof

- Bank Account Passbook

- Passport-size Photograph

- Mobile number linked with Aadhaar

All documents must be valid and up to date to avoid application rejection.

How to Apply for Thayi Lakshmi Bond Scheme

The application process is designed to be simple and accessible:

- Visit your nearest Gram Panchayat, Taluk Office, or designated government service center

- Collect the Thayi Lakshmi Bond Scheme application form

- Fill in all details carefully, including personal and bank information

- Attach photocopies of required documents

- Submit the completed form to the concerned officer

- After verification, the bond approval process will begin

- Once approved, confirmation will be sent via SMS or official notice

In some areas, online or assisted digital application options may also be available through government portals.

Conclusion

The Thayi Lakshmi Bond Scheme is a meaningful step toward women empowerment and financial inclusion in Karnataka. By offering secure savings and future financial support, the scheme helps women lead a more confident and stable life. Eligible beneficiaries are encouraged to apply as early as possible and take full advantage of this government initiative.